Was the “Great Recession” the first of many Peak Oil recessions?

There is a full and growing library of books describing what caused the recent breakdown of the global financial system and the “Great Recession”. You can take your pick from political pamphlets, popular vitriol, narrative retelling, or occasional reasoned analysis. You can read in depth about mathematical tools such as the Black-Scholes cupola for pricing Options, financial de-regulation, the chase for yield, financial innovation & securitisation, or simply kick back and dream of Black Swans… You can marvel at CDOs, CDO squared, political manoeuvrings, NINJA loans, subprime shenanigans and the role of psychology in the housing bubble… And you can shake your head when looking at the merry-go-round Wall Street and Washington…

But what I haven’t been able to find is a clear description of the role of energy in our recent troubles.

Was it an issue? Was the price of oil a relevant variable in the crash?

I think it might be.

The concept is relatively simple. Ignoring the thorny question of timing, Peak Oil simply states that at some point oil production will not be able to keep up with oil demand. It is not that the world will run out of oil, but simply that one day daily demand will outstrip the ability of the industry, of the earth, to supply it. Many published books and websites go on to paint an apocalyptic picture of a post-peak world immediately thrown into $400 oil, collapsing civilisation, failing food chains, and a survivalist economy. But, what happens if it is not quite as simple and stark as this? What happens if what you get is just a common old recession? And then another one, and then another, and another, as global demand bounces along a viscous ceiling of global supply. Each spurt of growth would trigger more oil demand, as the production ceiling approaches spare capacity would decrease and oil prices would increase, this would then drag on growth and eventually cause a recession, destroying demand. As demand falls, prices relax somewhat, allowing the economy to pick up, growth the return. Throw in a few financial innovations, bailouts, political mismanagement, the 99%, the 1%, shake it all about, wash, and repeat …

Recently, large production increases from unconventional oilfields, and the easily digestible story of home-grown American technological innovation tweaking the nose of fate once more, has meant that Peak Oilers have fallen from the zeitgeist and are once again held in scant regard… doomsters if you will. But we may have just lived through the first peak oil recession, and even with unconventional production, there may be more in the future.

Could this be true?

What does it mean for an economy based on debt?

Taking a look at the 21st century history of oil prices, OPEC spare capacity, inflation rates, and Central Bank base rates is thought provoking.

We are a society that eats, drinks, and lives debt. Our economy is based upon it, and we require growth to constantly drag us out of it. Without growth our debts overwhelm us, everyone stops buying, and we fall into a recession and all the travails and troubles that ensue.

Are Oil and Debt Immiscible?

Let’s think of our recent past.

“We may be on the verge of a decade of deflation.” Gregory Mankiw, Forbes, 1998

“Crude is gushing from the ground at the rate of 66m barrels a day, half as copiously again as in OPEC’s prime. The world is awash with the stuff, and it is likely to remain so.” The Economist, March 4th 1999.

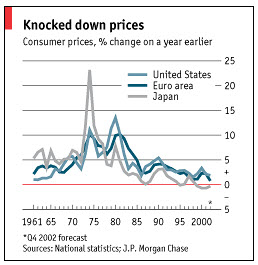

By the turn of the 21st Century economists were observing the growing productive might of China, and the continuing fall of year on year inflation, and beginning to worry about deflation.

“The Risk of Falling Prices is Greater Than At Any Time Since The 1930s…

For decades inflation was the bogeyman in rich countries. But now some economists reckon that deflation, or falling prices, may be a more serious threat—in America and Europe as well as Japan. That would be decidedly awkward, given the surge in borrowing by firms and households in recent years. Particularly worrying is the rise in borrowing by American households to finance purchases of houses, cars or luxury goods. Deflation would swell the real burden of these debts, forcing consumers to cut their spending.” The Economist, October 10th 2002.

Deflation, the New Bogeyman – Economist

Of Debt, Deflation, and Denial – Economist

Deflation is our civilisation’s worst nightmare. In a deflationary world our debts rise and rise each year in real terms. Eventually we drown in a sea of IOUs. Ever since the Federal Reserve has been able to, it has been fighting deflation.

With the dotcom bust and the terrorist attacks of the early 2000s destroying demand, and Chinas ascent as the world’s workshop rapidly increasing output, the FED was concerned that a deflationary spiral was possible. But Alan Greenspan wasn’t without ammunition – he fought a high profile battle with deflation, lowering interest rates through the first few years of the century. To be honest, this may have worked – the deflation genie was kept in the bottle. But it the price was that low interest rates encouraged people to borrow, and to consume, and of course, the great housing bubble. Continued growth was great, but it meant increased global demand for oil, and sowed the seeds for the next, bigger calamity.

HOW long ago it now seems that markets—and the Federal Reserve—were transfixed by the spectre of deflation. In fact, it was exactly a year ago that the yield on ten-year Treasuries dropped to 3.1%. But the spectre proved just that… The new spectre is inflation; a few even think that thanks to a potent mix of cheap money, huge government spending and a weaker dollar, inflation is about to take off.” Buttonwood, The Economist, June 9th 2004.

Global energy demand continued to grow, driven primarily by the rapid growth of the emerging economies. Indeed, the BRIC acronym was invented by Jim O’Neill in 2001 at Goldman Sachs.

But production capacity didn’t grow nearly as fast. OPEC’s spare capacity fell from 6.34 mmbpd in Q2 2002 to just 0.71mmbpd in Q4 2004, and oil prices were climbing. With each passing month the world began to worry less about deflation but more about inflation. And inflation did increase through ’04 and ’06, even whilst the FED raised interest rates to fight it. People began to notice. They worried about the price of gas/petrol at the pump.

In August 2006 the Lundberg Survey recorded a record of high of $3.03 for a gallon of self-serve regular, higher than the Hurricane Katrina high of $3.02. In that same year Matthew Simmons published “Twilight in the Desert: The Coming Saudi Oil Shock”.

The global economy kept growing, and growing. With a housing bubble now in full swing around the world, driven by those low interest rates used to fight deflation at the turn of the century, most people were piling on the debt. You couldn’t lose. The economy was growing, your house was your ATM, new and shiny things poured out of China at ever decreasing prices. What could possibly go wrong?

Oil prices continued to rise. There was a brief respite in 2007, as OPEC spare capacity increased briefly, but soon the trend returned, spare capacity fell, and the price of oil rose yet again. Soon it was approaching $80bbl. Stockbrokers were beginning to notice a slow-down in the economy. Results began to disappoint. The US was about to enter an equity bear market. Fund managers looked around for more yield, noting oil’s ascent. And yet global demand continued to increase, and OPEC spare capacity continued to fall. The price of oil continued to increase, and by now inflation was significantly higher than it had been for years. This was toxic. The combination of high debt, high inflation, high fuel prices, and higher interest rates meant that US and western consumers had less money to spend. Finally, to the great surprise of some, perhaps most, the US entered a recession, and finally the crows came home to roost. All the magic debt, the clever finance, the Emperor’s new clothes, could no longer be hidden. It was all interconnected, vulnerable, and highly leveraged. In a recessionary economy the payments could not be met. Houses started to sell less quickly, prices started to fall. Lehman brothers collapsed on September 15th 2008.

The global financial system went into free-fall. No one knew who owed whom what. Banks failed, countries defaulted, trade collapsed, and the world stood on a precipice of depression. Oil demand fell swiftly. OPEC spare capacity increased rapidly, and the price of Brent crude dropped like a stone from nearly $140 bbl to ~$40 bbl in just a few months.

With the inevitability of an action hero, the Central Banks stepped in. First, at least according to him, the UK’s Gordon Brown, but soon the whole global system. Those too big to fail were bailed out (and of course, nearly all of the bankers and the hubris that helped lead us all to this point, but that’s another story). And once the Central Banks had done that the FED was worried once more about deflation. Toxic deflation. Unable to lower interest rates below zero they decided to call in the helicopters. QE1, the first round of quantitative easing, was announced, flooding the financial system with cash. Keeping the banks and the whole financial system afloat. And it seems that at least some of this free money made its way back into commodities, as oil prices rose even as OPEC spare capacity increased. In just a couple of years the spot price of Brent was back towards its record levels, well over $100bbl. And that is where it continues to trade today.

So, we had a recession because we couldn’t, as a culture, pay our debts. We couldn’t pay our debts because interest rates and inflation were higher. Interest rates and inflation were higher because the price of oil was high. And the price of oil was high because the demand for oil had reached our ability to produce it.

After all, at the end of the day money isn’t just binary digits in a computer network somewhere, it’s a call on real work, on real energy, on the work embodied in a barrel of oil.

We really might have lived through the first peak oil recession, and it nearly pulled us into the abyss. It took all of the world’s financial will and might to prevent a depression, and we’re still not out of the woods. The political and economic fallout continues to dominate the news.

Can it be that simple?

Pingback: The Shift Project | The View from the Mountain

Pingback: Syrian Oil, and… what caused the war? | The View from the Mountain